In the realm of corporate maneuvers and geopolitical chess, the news reverberated: President Trump poised to intervene in a colossal transaction. Japanese conglomerate, SoftBank, eagerly sought to acquire U.S. Steel, an iconic American enterprise entwined with the nation’s industrial heritage. Yet, in a surprising twist, the President threatened to wield his veto power to thwart the deal. As the world watched with bated breath, a modern-day David and Goliath saga unfolded, pitting a global titan against the resolute will of the Commander-in-Chief.

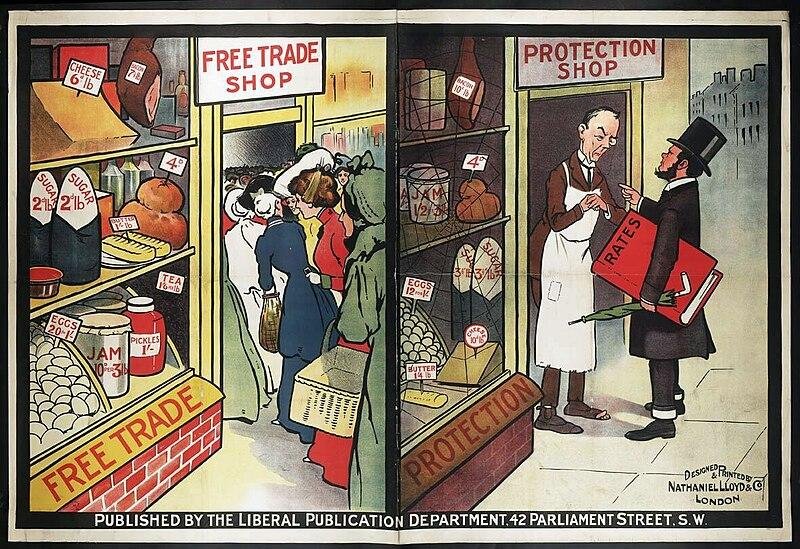

– Protectionism in the Steel Industry: Assessing the Impact of Trumps Decision on Japanese Takeover

Impact on Japanese Investment

Trump’s decision to block the takeover of U.S. Steel by Japanese firm Nippon Steel & Sumitomo Metal Corporation (NSSMC) is likely to have a chilling effect on Japanese investment in the United States. Japanese companies have been major investors in the U.S. steel industry for decades, and the Trump administration’s decision sends a message that foreign investment is no longer welcome. This could lead to a decline in Japanese investment in the United States, which would have a negative impact on the U.S. economy.

Consequences for the Steel Industry

The decision to block the takeover could also have a negative impact on the U.S. steel industry. Nippon Steel & Sumitomo Metal Corporation is one of the largest steel producers in the world, and its investment in U.S. Steel would have helped to modernize the U.S. steel industry and make it more competitive. Without this investment, the U.S. steel industry is likely to fall behind its global competitors.

– The Future of U.S. Steel: Balancing National Security Concerns with Economic Competitiveness

The implications of Trump’s executive order on the future of U.S. Steel and the broader steel industry are still uncertain. However, some experts believe that the order could have a significant impact on the company’s ability to compete in the global market.

According to a recent report by the Center for American Progress, the order could lead to higher prices for steel in the United States, which would make it more difficult for U.S. manufacturers to compete with their foreign counterparts. The report also warns that the order could lead to a loss of jobs in the steel industry, as companies are forced to cut production or move their operations overseas.

| Argument | Impact |

|—|—|

| U.S. Steel is a vital part of the U.S. economy and national security | Blocking the takeover could hurt the company and the U.S. economy |

| The U.S. steel industry is already struggling, due to unfair foreign competition | Blocking the takeover could make it harder for U.S. steel companies to compete |

| U.S. Steel has already taken steps to improve its competitiveness, including investing heavily in new technology | The takeover would allow U.S. Steel to continue to invest in its operations and remain competitive |

– Navigating the Complexities of Global Trade: Lessons Learned from the U.S.-Japan Deal

Complex trade negotiations often take years or even decades. The recent US-Japan negotiations, which resulted in a deal to reduce tariffs on US agricultural products, were no exception. Both sides made concessions to reach an agreement, and both sides will need to implement the deal in a way that benefits their respective economies.

One of the challenges of global trade is that it is constantly evolving. As new technologies and products emerge, new trade patterns develop. Policymakers and businesses need to be able to adapt to these changes in order to take advantage of new opportunities and avoid potential pitfalls.

In Summary

The implications of President Trump’s threat to block the sale of U.S. Steel to a Japanese firm reverberate through the corridors of global economics. This move signifies a shift in the tides of international trade and underscores the challenges that lie ahead in an era of uncertain diplomacy. As the market remains on tenterhooks, the fate of this proposed acquisition stands as a litmus test for the future of cross-border transactions and the geopolitical landscape they navigate.